by Andrew Fassnidge

Cash is king. Correction, cash was king. It seems cash has an enemy. Technology. Technology plays a huge role in economic development and supporting the growth of Africa. No matter the sector; be it e-commerce, banking, logistics, agriculture, health or education, digitalisation is the future and companies have to adapt or risk becoming obsolete. This means that the demise of cash on the continent is unavoidable. Africa’s most populous nation, Nigeria, recently had its central bank, the CBN, impose a cash-less policy, which stipulates additional charges on cash-based deposits and withdrawals. Sparkle’s CEO, Uzoma Dozie, hit the nail on its head in his Medium post “by making cash more expensive, which is what the CBN is attempting with this policy, they are actively driving people and businesses into the financial system.”

Ahead of our annual Africa Tech Summit last year, we took a deep dive into some of the various ways in which Fintech startups are addressing different customer pain points; this included facilitating payments, loans, savings and mobile money interoperability. In our analysis, we concluded that Fintech will still remain at the forefront of investments. We were right. According to Disrupt Africa’s Finnovating for Africa 2019: Reimagining the African financial services landscape, the number of active fintech ventures across the continent grew by 60% – from 301 to 491 – in the last two years. Globally, fintech is also dominating the scene, making significant inroads into the banking system as can be seen in Visa’s recent $5.3 billion acquisition of Plaid.

The African fintech sector remains attractive as the market expands and looks to drive financial inclusion by introducing different financial services into substantially underbanked markets. However, all is not as rosy as it seems. Africa, as a whole, is still largely cash-based. Mobile money growth is increasing, but slower as projected – it is now a time to identify what will cause consumers to abandon their long-established relationship with cash.

As we look to discuss the future of mobile money with some of Africa’s leading banks, mobile network operators [MNOs] and fintechs at the Africa Tech Summit Kigali, we probe into what some of them are currently doing on the continent to drive innovation and create a cashless society across the continent.

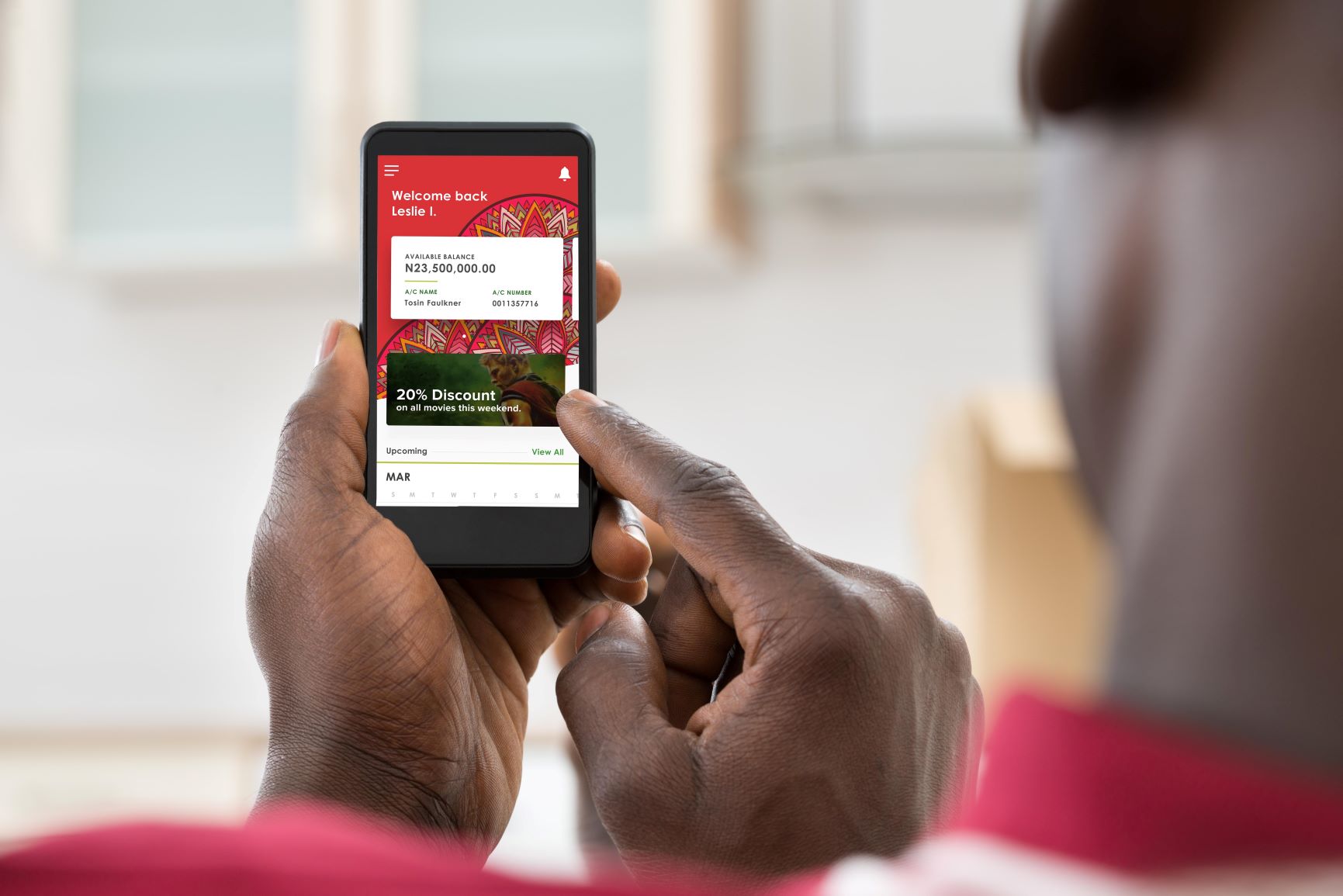

The world of mobile financial services is always evolving. Previously, MNOs owned the mobile fintech space but today, mobile money has extended beyond Safaricom’s initial M-Pesa offering, which enabled consumers to send and receive money quickly and securely. Africa’s mobile financial services has matured and diversified, enabling a broad array of financial services – thus allowing fintechs to establish a solid footing in the market. Most notably, fintech players have been addressing businesses’ pain points. Arguably two of the most prominent fintech startups on the continent, payment gateways Flutterwave and Paystack have transformed the way businesses accept payments online. Point of Sale payments provider, Yoco, continues to grow its payment network of small business merchants in South Africa. Last year, Carbon introduced Bloom, its business account for female-led enterprises.

Not willing to allow fintech to overtake, MNOs are creating offerings of their own. While many are without bank accounts, mobile phone ownership in Africa is on its way to being ever-present. With a broader reach when it comes to engagement and service delivery, telcos already have a massive customer-base, with unmet needs, who are ready to be introduced to new financial services. Owning two-thirds of Kenya’s mobile subscribers, Safaricom is a classic example of a successful MNO. With a mission to diversify its product and revenue streams, the telco predicts that in 3 years its pioneering digital payments will generate more revenue than all other parts of their business.

Not wanting to miss the boat, banks are looking to channel into new markets. Initially seeing enterprises serving the unbanked and underserved populations as a threat, Banks are now attempting to replicate fintech startups’ offerings. However, given the immaturity of the market, more profitable relationships are being formed – with telcos. Combining their ability to manage financial flows, banks are able to appeal to customers outside their normal target audience to develop the market for their services and attain future revenues; most recent example is Airtel Africa’s partnership with Ecobank Group. According to both parties, who are also speaking at this year’s Summit, the partnership will enable Airtel Money customers, through Ecobank’s digital financial services ecosystem, make online deposits and withdrawals, effect real time domestic and international money transfers, make in-store merchant payments, and access loans and savings products amongst others.

Fintechs are winning in certain areas, most notably in the lending and money transfers. However, the race is not over for banks and MNOs. MNO-led innovations will enhance financial inclusion on the continent and we will see banks develop their own distinctive mobile and digital services. As Africa shifts towards a cashless society, the distinction between fintech startups and traditional banks will be blurred.

AUTHOR: Andrew Fassnidge, Founder of the Africa Tech Summit

AUTHOR: Andrew Fassnidge, Founder of the Africa Tech Summit